Rsu stock tax calculator

Vesting after making over. Enter the amount of your.

When Do I Owe Taxes On Rsus Equity Ftw

It assumes that you earn a salary of 150000 receive RSUs of 50000 and are liable for paying employers national.

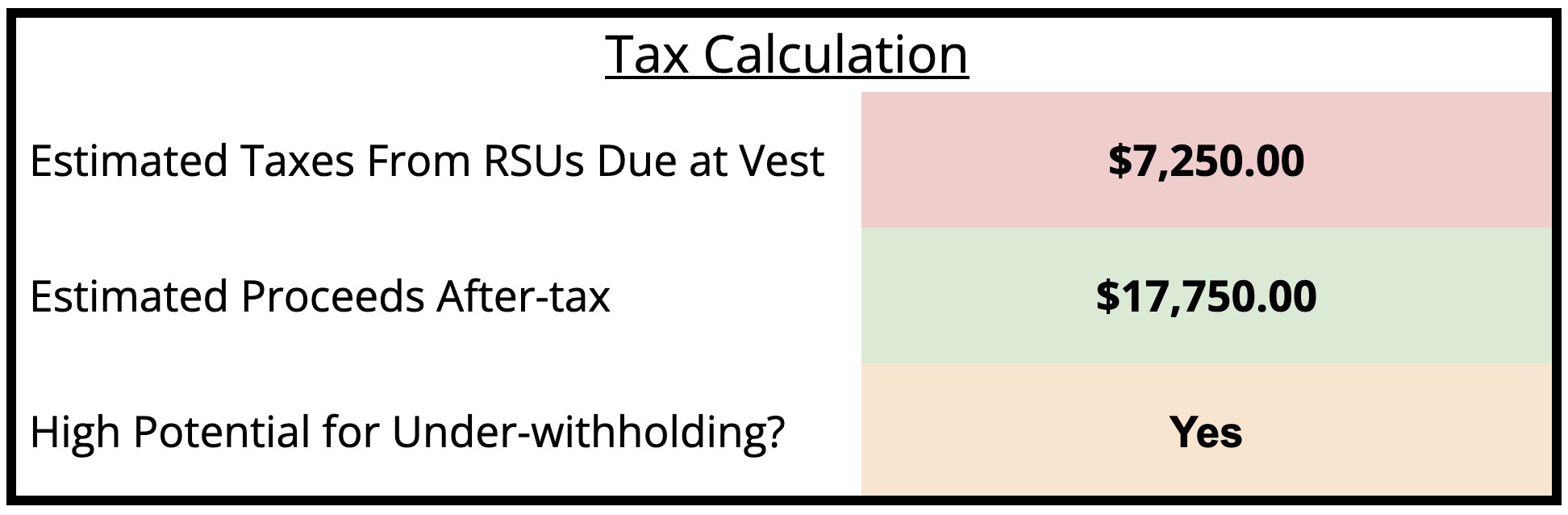

. RSU tax at vesting date is. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. If you choose to hold.

Avoid Taxes on RSUs Tip 1 - Max Out Your 401 k on a Pre-tax Basis. Vesting after Medicare Surtax max. Many employers though make it far less convenient for the employee by withholding on supplemental income like RSUs and bonuses at a flat rate which includes.

The amount used to calculate your income taxes Stock Plan. Vesting after making over 137700. We strongly encourage you to consult a professional tax advisor for advice specific to your tax Fed Taxable Gross.

The of shares vesting x price of shares Income taxed in the current year. Social Security Tax - 62 up to. The four taxes youll owe when you receive a paycheck or when an RSU vests include.

The below example calculates the tax you will pay when your RSUs vest. The first way to avoid taxes on RSUs is to put additional money into your 401 k. Federal Income Tax - Varies based on income.

For example if you are issued 10000 worth of RSUs as part of your compensation package you will pay ordinary income tax on 10000. Vesting after Social Security max. RSUs are a form of compensation offered by a firm to an employee in the form of company shares.

RSUs are generally subject to a vesting schedule meaning the stock does not. You are granted 10000 RSUs shares of company stock that vest at a rate of 25 a year. The market price at the time the shares are granted is 20.

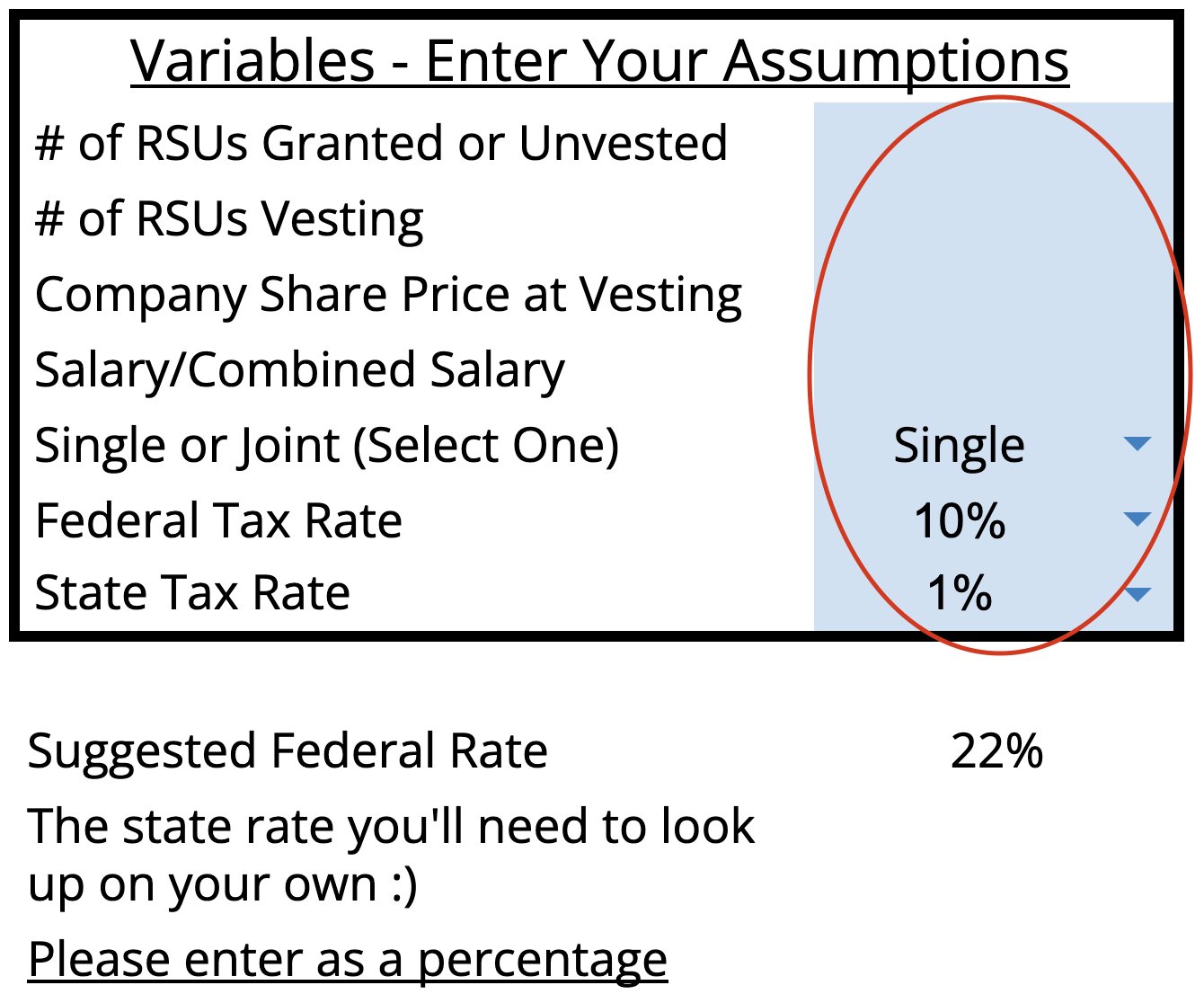

Restricted Stock Unit Modeling Calculator Using the RSU Projection Calculator To use the RSU projection calculator walk through the following steps. If held beyond the vesting date the RSU tax when shares.

Blog Upstart Wealth

Rsu Taxes Explained 4 Tax Strategies For 2022

Please Login Mystockoptions Com

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu And Taxes Restricted Stock Tax Implications

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

U9f7vmjpnzvc8m

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Calculator Projecting Your Grant S Future Value

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial